Property In Current Use . the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. let’s start with a definition: Why does forest land need.

from www.slideserve.com

current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. let’s start with a definition: uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. Why does forest land need.

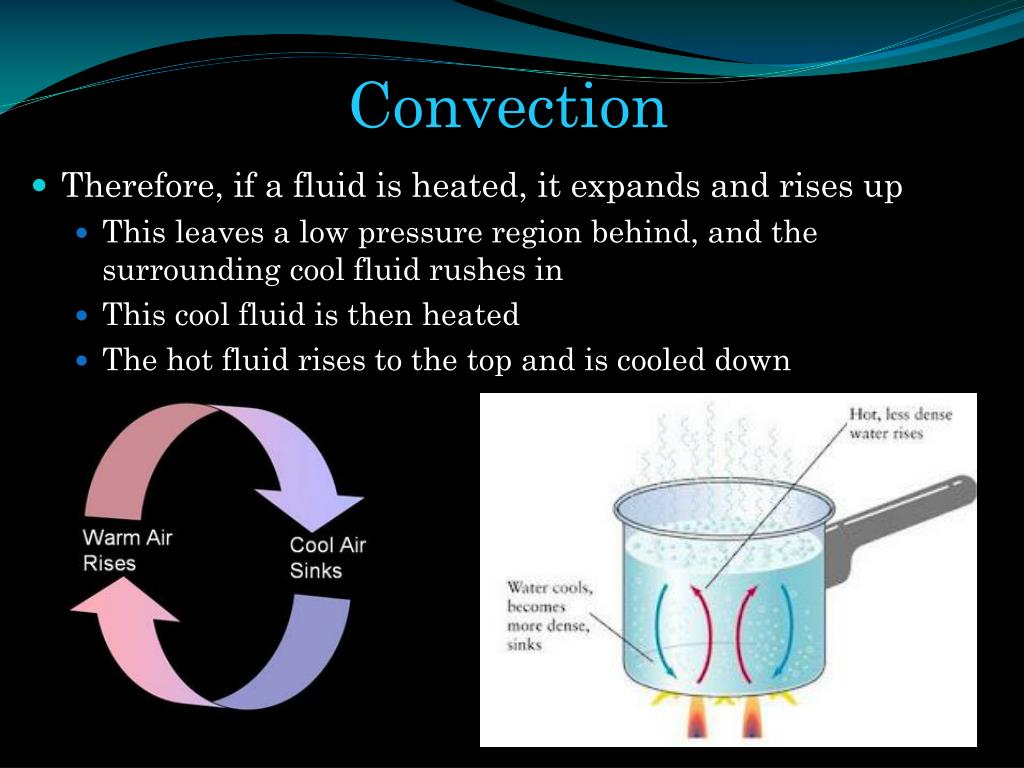

PPT Convection Currents PowerPoint Presentation, free download ID

Property In Current Use Why does forest land need. uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. Why does forest land need. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. let’s start with a definition:

From www.chegg.com

Solved For the circuits shown in Fig. P6.35(a), (b), (c), Property In Current Use current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. let’s start with a definition: Why does forest land need. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. uva or. Property In Current Use.

From edurev.in

Difference between AC and DC current.? EduRev Class 10 Question Property In Current Use uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. Why does forest land need. let’s start with a definition: the use value appraisal program (uva),. Property In Current Use.

From www.youtube.com

Current vs Non Current Assets Explained Simply! YouTube Property In Current Use the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is. Property In Current Use.

From circuitlibbrooses.z21.web.core.windows.net

How To Calculate Current Flow In Circuit Property In Current Use uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. let’s start with a definition: the first, and perhaps most obvious, policy rationale for current use. Property In Current Use.

From guidediagramtolings.z5.web.core.windows.net

What Is Definition Of Electricity Property In Current Use uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by.. Property In Current Use.

From schematiclisttabun101.z19.web.core.windows.net

Current Flow In A Circuit Diagram Property In Current Use the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. Why does forest land need. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. uva or “current use” is a property tax incentive for. Property In Current Use.

From www.wallstreetmojo.com

Property Plant and Equipment Meaning, Formula, Examples Property In Current Use uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. let’s start with a definition: Why does forest land need. current use programs help. Property In Current Use.

From www.printablerealestateforms.com

[PDF]Free Printable Property Information Sheet Template Property In Current Use Why does forest land need. uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. let’s start with a definition: the use value appraisal. Property In Current Use.

From terrared.com

Property Tax in Trinidad & Tobago The Facts RED by Terra Caribbean Property In Current Use the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. let’s start with a definition: uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use is a tax assessment law that taxes land at. Property In Current Use.

From docs.tooljet.com

Enable/Disable a Component Using Current User's Property ToolJet Property In Current Use the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. let’s start with a definition: Why does forest land need. current use. Property In Current Use.

From www.chegg.com

Solved 2. The bound surface current density Kb of a Property In Current Use let’s start with a definition: current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use programs help ensure that your land is. Property In Current Use.

From www.redfin.com

6233 New Glasgow Rd, Scottsville, KY 42164 MLS RA20230234 Redfin Property In Current Use let’s start with a definition: the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. Why does forest land need. the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. uva or “current use” is a property tax. Property In Current Use.

From property-sourcing.co.uk

Understanding the Current Trends House Prices, Transactions, and Property In Current Use uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. Why does forest land need. the first, and perhaps most obvious, policy rationale for current use programs. Property In Current Use.

From www.metrohomesolutions.com

Selling Inherited Property A Guide to Making the Most of Your Property In Current Use current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. current use programs help ensure that your land is valued according to those benefits and services when. Property In Current Use.

From tallysolutions.com

Current Assets Definition, Types and Examples Tally Solutions Property In Current Use current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. the first, and perhaps most obvious, policy rationale for current use programs is the desire to keep working lands working and. Why does forest land need. uva or “current use” is a property tax. Property In Current Use.

From exofzuzoa.blob.core.windows.net

What Is A Land Use Agreement at Robert Yagi blog Property In Current Use current use is a tax assessment law that taxes land at its “productive capacity.” this means the land is taxed at its income. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. uva or “current use” is a property tax incentive for eligible land whose “current use” is for. Property In Current Use.

From www.innerspec.com

Eddy Current Technology Property In Current Use the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. uva or “current use” is a property tax incentive for eligible land whose “current use” is for forest products. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around.. Property In Current Use.

From theengineeringmindset.com

AC vs DC alternating current and direct current The Engineering Mindset Property In Current Use Why does forest land need. current use programs help ensure that your land is valued according to those benefits and services when tax time rolls around. the use value appraisal program (uva), or more commonly called current use, was implemented in 1980 by. the first, and perhaps most obvious, policy rationale for current use programs is the. Property In Current Use.